You can invest in stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, and more. SoFi doesn’t charge commissions, but other fees apply (full fee disclosure here). A debt ratio of 0.2 shows that it is very unlikely for Company C to become bankrupt, even if the economy were to crush. For instance, let’s assume that a company is interested in purchasing an asset at a cost of $100,000. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

What is the debt to equity ratio?

- ✝ To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score.

- Another benefit is that typically the cost of debt is lower than the cost of equity, and therefore increasing the D/E ratio (up to a certain point) can lower a firm’s weighted average cost of capital (WACC).

- When assessing D/E, it’s also important to understand the factors affecting the company.

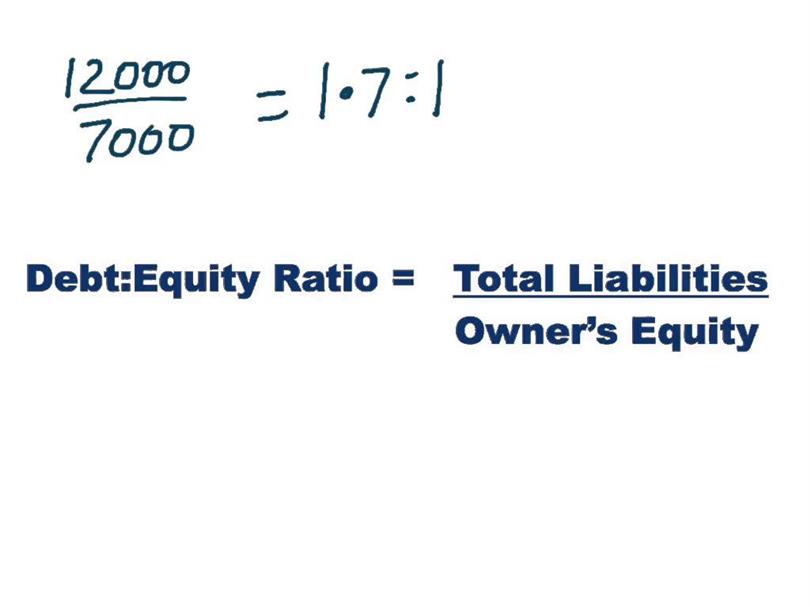

- In other words, the debt-to-equity ratio shows how much debt, relative to stockholders’ equity, is used to finance the company’s assets.

Financial leverage allows businesses (or individuals) to amplify their return on investment. Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy. The opposite of the above example applies if a company has a D/E ratio that’s too high. In this case, any losses will be compounded down and the company may not be able to service its debt.

Optimal Capital Structure

Investors often scrutinize the Debt to Equity ratio before making investment decisions. A company with a high ratio might be seen as risky, whereas one with a lower ratio could be viewed as more stable. Different sectors have varying norms, and it’s essential to compare against industry averages.

How do you know if the debt-to-equity ratio is good?

In addition, debt to equity ratio can be misleading due to different accounting practices between different companies. Total equity, on the other hand, refers to the total amount that investors have invested into the company, plus all its earnings, less it’s liabilities. Below is a short video tutorial that explains how leverage impacts a company and how to calculate the debt/equity ratio with an example.

Example Calculation of D/E Ratio

A company with a higher ratio than its industry average, therefore, may have difficulty securing additional funding from either source. This ratio compares a company’s total liabilities to its shareholder equity. It is widely considered one of the most important corporate valuation metrics because it highlights a company’s dependence on borrowed funds and its ability to meet those financial obligations. By learning to calculate and interpret this ratio, and by considering the industry context and the company’s financial approach, you equip yourself to make smarter financial decisions.

Debt-to-Equity (D/E) Ratio Formula and How to Interpret It

As a general rule of thumb, a good debt-to-equity ratio will equal about 1.0. However, the acceptable rate can vary by industry, and may depend how to compute overhead variances on the overall economy. A higher debt-to-income ratio could be more risky in an economic downturn, for example, than during a boom.

As noted above, the numbers you’ll need are located on a company’s balance sheet. Determining whether a company’s ratio is good or bad means considering other factors in conjunction with the ratio. In addition, the reluctance to raise debt can cause the company to miss out on growth opportunities to fund expansion plans, as well as not benefit from the “tax shield” from interest expense.

However, in this situation, the company is not putting all that cash to work. Investors may become dissatisfied with the lack of investment or they may demand a share of that cash in the form of dividend payments. At first glance, this may seem good — after all, the company does not need to worry about paying creditors. Like the D/E ratio, all other gearing ratios must be examined in the context of the company’s industry and competitors.